2023 Non-Alcoholic Beverages Trends

The “sober curious” trend is continuing to make waves this summer, and while non-alcoholic beers and cocktails are enjoying their time in the sun, they’ll never be able to outshine the dominance held by true non-alcoholic beverages: coffee, soda, juice, energy drinks, and water. While alcoholic beverages result in around $253 billion annually, non-alcoholic beverages generate nearly twice that much with an annual revenue of $447 billion.

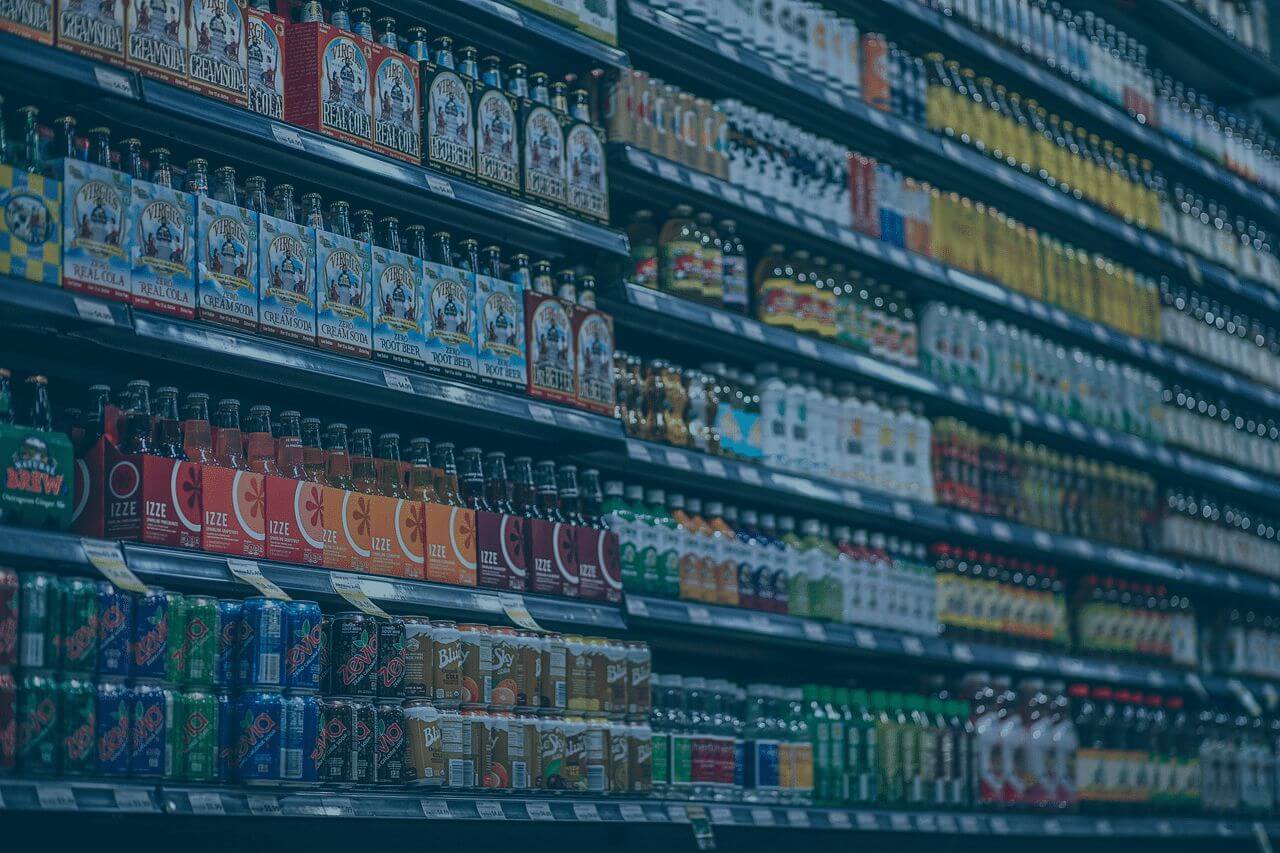

It’s no surprise that the beverage industry is so successful—all of us have absentmindedly grabbed a soda while checking out at the grocery store or gone out of our way on a road trip to pick up our favorite energy drink. But with so many options in the cooler, including some of the most beloved brands of all time, how do emerging brands stand out, and how do traditional brands keep up with consumers’ changing tastes?

We’re taking a look at some of the hottest non-alcoholic trends you might see this summer and how beverage brands can keep up with the changing climate.

The Boom of Better-for-You

The past few years have pushed consumers to prioritize healthy habits, with nearly 85% of consumers choosing some form of healthy consumption—whether it’s gluten-free, reduced sugar, or “better-for-you” drinks. Kombucha in particular has experienced massive growth. The category grew from $1 million in sales in 2014 to $1.8 billion in sales in 2019, with the total number of brands increasing by about 30% yearly for the last several years.

Other wellness-focused drinks, like CBD-infused beverages, are also capturing the attention of conscious consumers. The market for these drinks is expected to reach $14.6 million by 2026, starting from just $3.4 million in 2020. Collagen water, another health-focused beverage, is also expected to see a compound annual growth rate of 12% through 2023. With such a large shift toward health and wellness, we can expect to see even more emerging brands vying for consumer attention in the next few years.

The Flavors of Summer

When the weather gets hotter, there’s nothing like indulging in a refreshing drink with bright, vibrant flavors. This year, beverage brands have been unveiling new flavors that perfectly capture the essence of summer. Earlier this summer, Red Bull released its Summer Edition Juneberry flavor, creating the perfect pick-me-up for summer road trips or pool lounging. They’ve also partnered with Sonic to release the flavor as a slushie at Sonic restaurants.

Another classic drink, Dr Pepper, also recently released a new fruity flavor for summer. Their Strawberries and Cream soda offers a nostalgic twist, reminding drinkers of summers past.

These innovative releases prove that non-alcoholic beverage companies are committed to making memorable experiences for their customers by continually reinventing and innovating.

Water: More Than Just Hydration

Even though reusable water bottles are more popular than ever before, bottled water is still the most popular packaged beverage in the United States, with a massive 15.9 billion gallons sold in 2022. Despite slower growth, this number is continuing to increase annually, and brands are beginning to tap into new trends as they try to win sales and category share. In line with the better-for-you trend, one area experiencing major growth is enhanced waters. Flavored sparkling water, for example, grew 5% in 2022, while non-flavored sparkling water grew by 8.5%.

However, after COVID-19, consumers are expecting more from their water than just hydration, with 47% seeking out beverages that boost their immunity as well. The value-added water segment has seen steady growth because of this, and waters featuring functional ingredients like alkaline, electrolytes, and collagen, have been gaining popularity—and shelf share.

What about Soda?

Despite 16 years of volume decline, soda and carbonated soft drinks are the second-leading non-alcoholic beverage consumed by Americans, holding a 19% share of total packaged beverages consumed. The three largest soda companies—Coca-Cola, PepsiCo, and Keurig Dr Pepper—own 94% of the total $37 billion U.S. market, leaving little room for emerging brands. But, if consumers are expecting more from water, are they beginning to expect more from soda as well? “Healthier” and functional sodas are beginning to enter the market, taking the shelves and social media by storm. Brands like Olipop and Poppi are aiming to replace traditional sodas and offer a new experience, with Oilipop reaching $200 million in annual sales by April 2023.

These probiotic sodas may be trending right now, but can their success be sustainable against the beloved giants in the traditional soda industry?

Success in Summer and Beyond

Similar to the alcohol industry, the non-alcoholic beverage industry is experiencing significant growth and evolving trends this summer. The future success of emerging brands in the non-alcoholic beverage industry depends on their ability to meet consumer expectations for healthier options, functional benefits, and unique experiences. These shifts are opening up opportunities to refresh product categories, innovate long-standing products, and go up against competitors to connect with consumers on a new level.

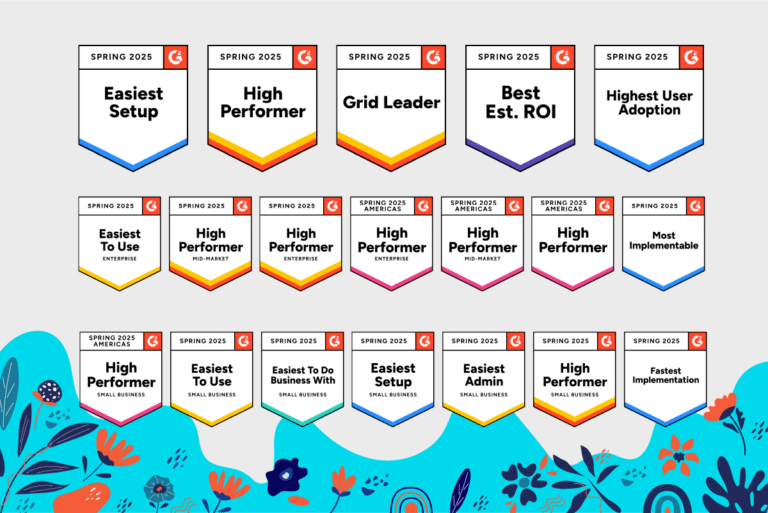

One of the ways beverage brands can keep up with evolving trends is by adopting new technologies. FORM’s Image Recognition AI is the fastest, easiest, and most accurate retail execution app for beverage brands to track and improve performance. Our powerful computer vision AI can detect and analyze drinks on shelves and in cooler to enable teams to save time, track execution, and boost category share. Curious how it works? Take an interactive product tour here, and check out more resources on our Image Recognition technology here.